Guaranteed Asset Protection

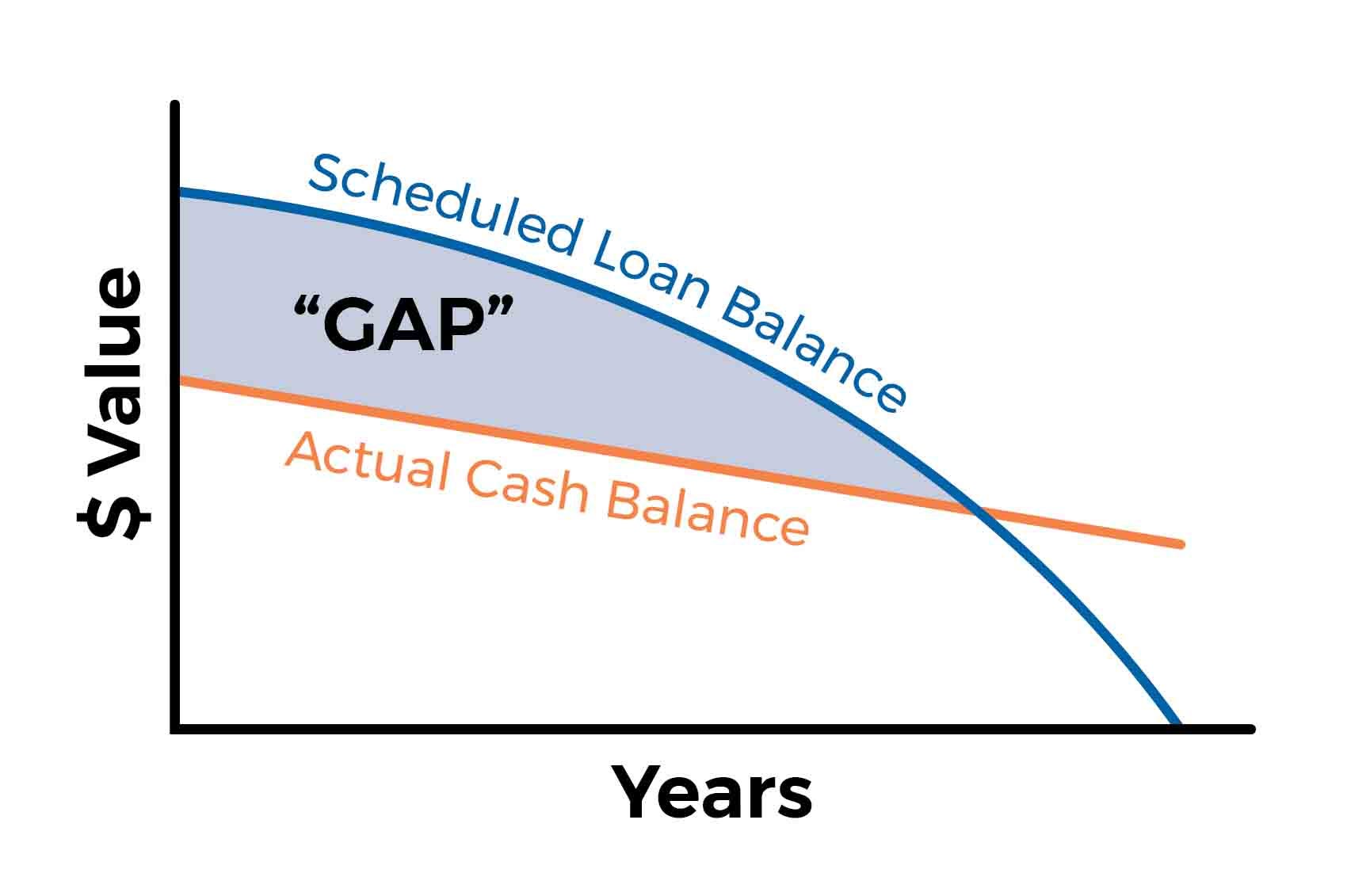

If you’ve never heard of GAP – Guaranteed Asset Protection – you may be wondering what it is and why it’s important to consider when you purchase a wheelchair van? Put simply, GAP comes to the rescue in the event, your wheelchair accessible vehicle is ever declared a total loss and you owe more on your loan than you’ll receive from your insurance company.

What is Guaranteed Asset Protection?

Guaranteed Asset Protection (GAP) is not GAP Insurance; it's GAP coverage, which works similarly and ensures your vehicle is protected. For example, in the event of an unrecovered theft, collision, or fire, your wheelchair van may be worth less than the amount you owe on your loan at the time of total loss. In most cases, you would be required to pay the difference between the vehicle’s value and the existing loan amount. With GAP, that difference is covered, keeping you clear of any further financial responsibility. BraunAbility can assist you in obtaining this coverage.